Defining a University internal customer

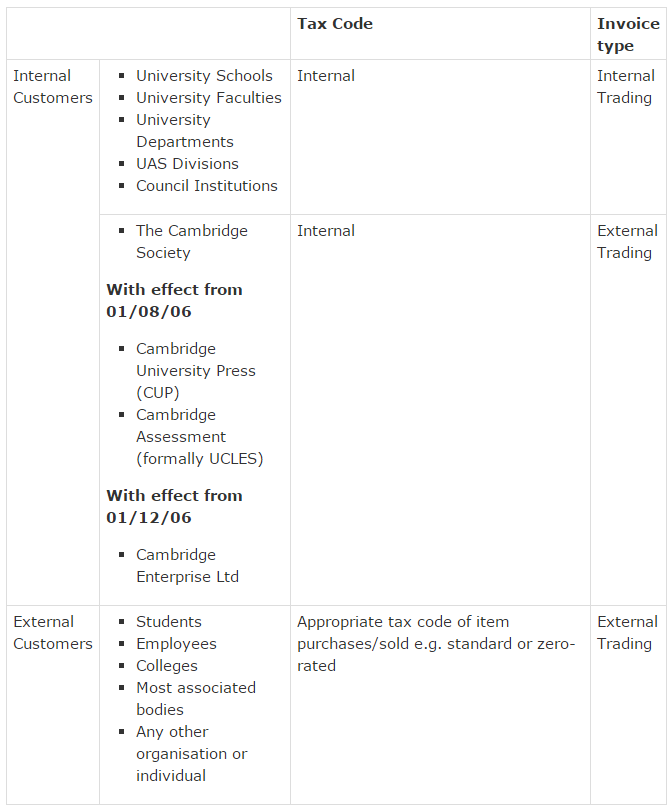

Internal customers are those that are part of the legal entity of the University e.g. the Schools, faculties and departments.

With effect from the 1st August 2006 HM Revenue & Customs have ruled that the University, Cambridge University Press (CUP), Cambridge Assessment (formerly UCLES) are a single entity and as such must also have the same VAT number. Prior to this HMRC have also included The Cambridge Society within the University's VAT registration and Cambridge Enterprise is also included from the 1st December 2006.

Therefore, the tax code of 'internal' should be allocated for transactions with all these organisations. However, as only University departments are using UFS you must not use either internal trading or raise an internal invoice to any of the organisations listed in the paragraph above, as internal trading invoices are only used for trading between University departments using the entity code 'U' in UFS.

- Each internal customer has a two-letter 'department code' which in most instances coincides with the two letters at the beginning of their departmental cost centres.

- Every internal customer has been pre-allocated a customer number that MUST be used when creating internal transactions. These internal customer records have been created centrally and include data that enables the Internal Trading process to work.

- Any amendments to, or new internal customers can only be successfully carried out by the Finance Division - forward any queries to ARCustomer@admin.cam.ac.uk

| A full listing of departments, their two-letter code and their Accounts Receivable internal customer number is available from the Finance Division website: https://www.finance.admin.cam.ac.uk/departmental-contacts |

Sub-departments within a larger department

Sub-departments within larger departments must be treated as an additional 'Bill To' location within the main department's customer number.

For example: Temporary Employment Services (TES) of Personnel Division has its own cost centres. Departments needing to raise an invoice to TES must use the internal customer number allocated to the Personnel Division and then create a new address line within the customer with TES' details.

VAT

All internal trading invoices do not attract VAT. The VAT code used must be INTERNAL.