|

This guidance is intended for the visitor. Departments can find additional guidance on the Finance Learning Hub |

Expense types and alerts

On this page:

General guidance on creating a claim can be found here

Expense Types

-

Accommodation

- Hotel/B&B accommodation

-

Business Mileage

- Claiming mileage for travelling in your own car

-

Conference/event fee

- This expense type should be used for claiming fees for conferences and events

-

Meals and Subsistence (individual)

- This expense type should be used when claiming for individual meals purchased during the visit such as lunch.

-

Other costs

- To be used for any expenses not covered by one of the other expense types.

-

Per Diem

- A daily rate paid to cover expenses during visit to Cambridge.

- If relevant, the rate to be used will have been provided by the department.

-

Research Participation Payments

- Amounts paid to an individual for participating in research.

-

Travel

- This page will provide guidance on the fields that need to be completed for the following types of travel:

- Air Travel

- Mileage

- Parking, tolls etc

- Public Transport

- Taxi

- Travel Visa

- This page will provide guidance on the fields that need to be completed for the following types of travel:

Alerts

| Indicates a required field in the form, the page cannot be submitted unless all the required fields are completed | |

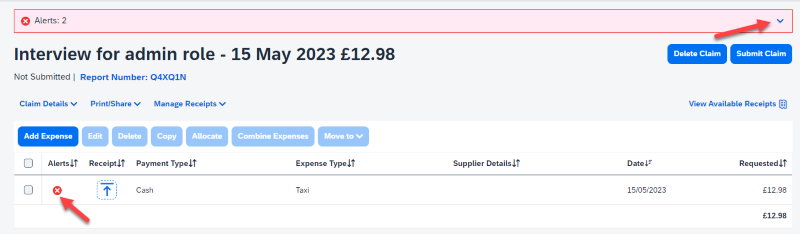

| A warning, this indicates that something is missing or incorrect. These alerts should be reviewed and resolved before the claim is submitted. | |

| A hard alert, these indicate an error which means that the claim cannot be submitted until they are resolved. |

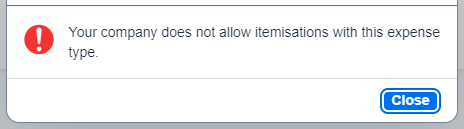

There is sometimes an itemisation tab displayed but no itemisations are available for that expense type. If this message is displayed, the itemisation tab can be ignored.

The alert symbol will display against any expense line with an issue. The full detail of any alerts in the claim can be found by expanding the alert bar at the top of the screen