Each month check income and expenditure. Ensure that the funds are being used for proper purposes in accordance with the rules of the specific fund and the University's general charitable purposes.

This section contains the following:

- Trust Fund Financial Statements

- Reading the statement

- Using the GL Account Enquiry screen in UFS

- Month End procedures

Trust Fund Financial Statements

The Trust Funds Assistant will prepare monthly Trust Fund Financial Statements, once the GL has been closed, and will distribute them to the managers/administrators of the trust funds.

Once the statements have been received, they should be closely checked to ensure that:

- the trust fund expenditure has not exceeded the income

- expenditure has been charged to the correct trust fund

- the correct stipends (if any) are being charged to the fund

See Appendix A for an example of a Trust Fund financial statement.

Reading the statement

The statement is divided into three main sections.

Current Capital

This is split into two columns, the first showing the value of the permanent capital, and the second showing the value of the spendable capital.

Income &: Expenditure of Fund

The first column shows the estimated income to be received in the current financial year from the Cambridge University Endowment Fund (CUEF) units held in the fund. This figure is reached by the following:

- adding the number of permanent and spendable Cambridge University Endowment Fund (CUEF) units

- multiplying them by the income per unit for the financial year.

In the example statement:

- 2010/11 income per unit was £1.4543

- The annual income would be (8427+0) x 1.4543=£12,255.39

The second column shows the actual to date income and expenditures figure for the current financial year.

Revaluations and Transfers

This is split into two columns, the first showing movements in the permanent capital, and the second showing movements in the spendable capital in the current financial year.

It is better to wait until the 4th working day before processing deposit movement journals, as the Finance Division need to process journals relating to some Trust Funds, which will affect the balances on those funds.

Using the GL Account Enquiry screen in UFS

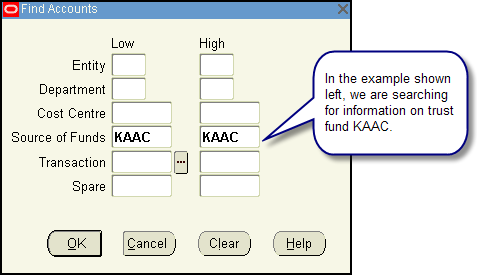

In the GL responsibility, the Account Enquiry Screen is useful for quickly looking up information on your trust funds.

To look up your trust fund:

- In GL Responsibility, select Enquiry then Account

- Enter the accounting periods from and to fields

- In the currency field select GBP unless you need to look up the number of Cambridge University Endowment Fund (CUEF) units that a trust fund holds, in which case type in STAT

- In the account flexfield box, type in the source of funds of your trust fund

- Select "Show Balances"

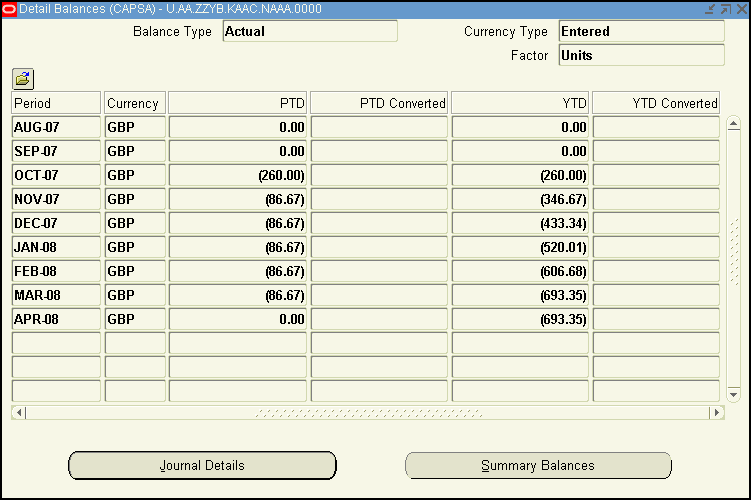

- To drill down to the information shown for the income received to date from the Cambridge University Endowment Fund (CUEF) from the same trust fund you would enter the source of funds code plus the transaction code e.g. NAAA in the flexfield box.

In the example shown below, we are searching for information on fund KAAC.

The example below shows that the CUEF income has been received by this trust fund monthly.

An Accounts Analysis - Transaction Detail 3 (UFS) report can also be run to show the same information.

Month End procedures

Each month end, departments should follow the month end timetable issued by the Finance Division and ensure that all Trust Fund transactions are processed before the GL closes (currently on the fifth working day of the following calendar month).

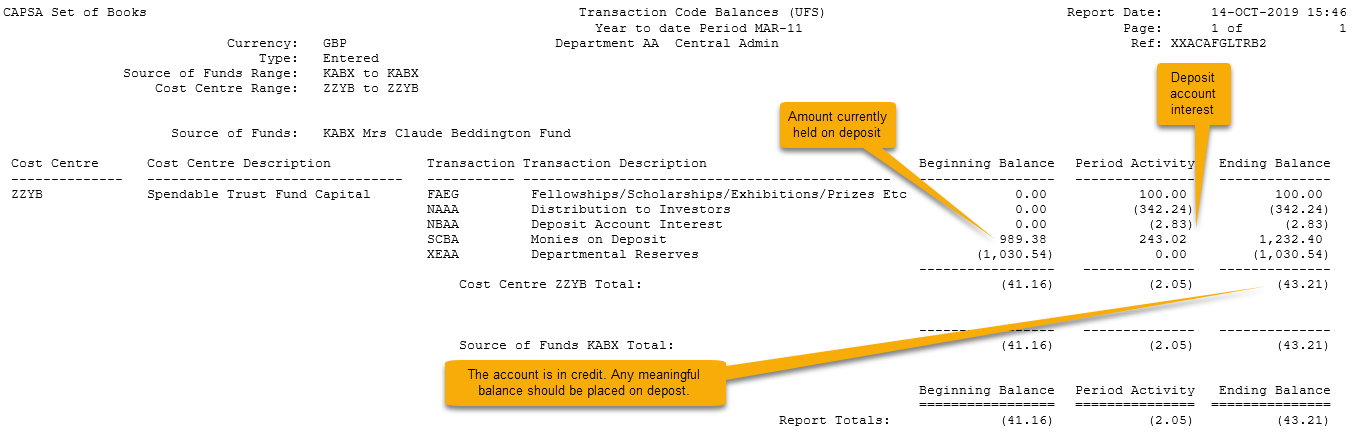

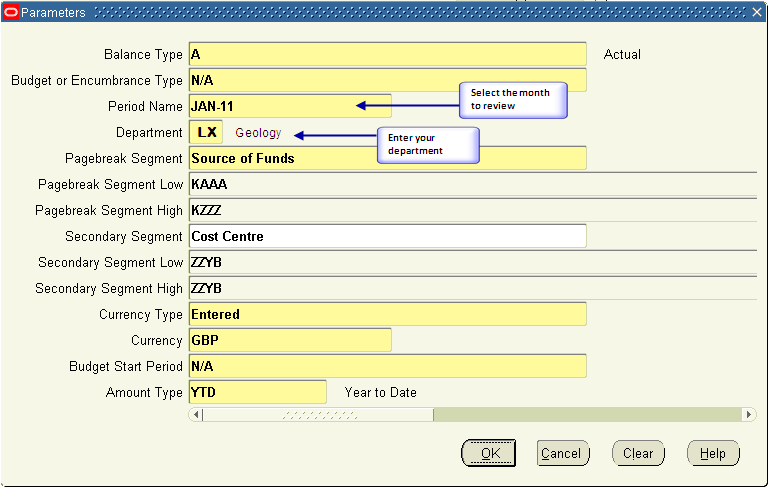

The best report to run off in the GL in order to review the month's activities is the "Transaction Code Balances (UFS)" report.

The parameters that you need to enter are as shown below:

Click on OK and submit the request.

The report will pick up all of your department's Trust Funds and show the activity on cost centre ZZYB, the spendable part of the Trust Fund.

What are the main transaction codes that I need to know about?

| AAAA-DZZZ | Stipends and wages |

| EAAA-JZZZ | Expenditure codes |

| EZYA | Central Overheads |

| KAAA-LZZZ | Income codes |

| NAAA | Income from CUEF units distributed quarterly |

| NBAA | Deposit account interest |

| NEAA | Income from other investments |

| SAAA | Value of CUEF units held and purchases and sales |

| SCBA | Moving money on to/off deposit |

| SCCA | Monies on deposit control account |

| XEAA | Departmental Researves (Balance of Fund brought forward from previous year) |

| XHAA | Revaluation of CUEF units |

When the report has run off, check the source of funds total at the end of the "Ending Balance" column.

Click the image to view a larger version

| Accounts Payable | All invoices should be processed by the 3rd working day after month end. |

| Accounts Receivable | All receipts should be processed by the 3rd working day after month end. |