What you can claim

Where possible the amounts an individual will have to advance from their own personal monies should be minimised by the use of a University credit card or by arranging for the supplier to invoice the University directly. The Employee Expenses Policy and Financial Procedures Chapter 5b - Expenses & Benefits provide more information and detailed guidance on what can be claimed, procedures to follow and possible tax implications of any payments made.

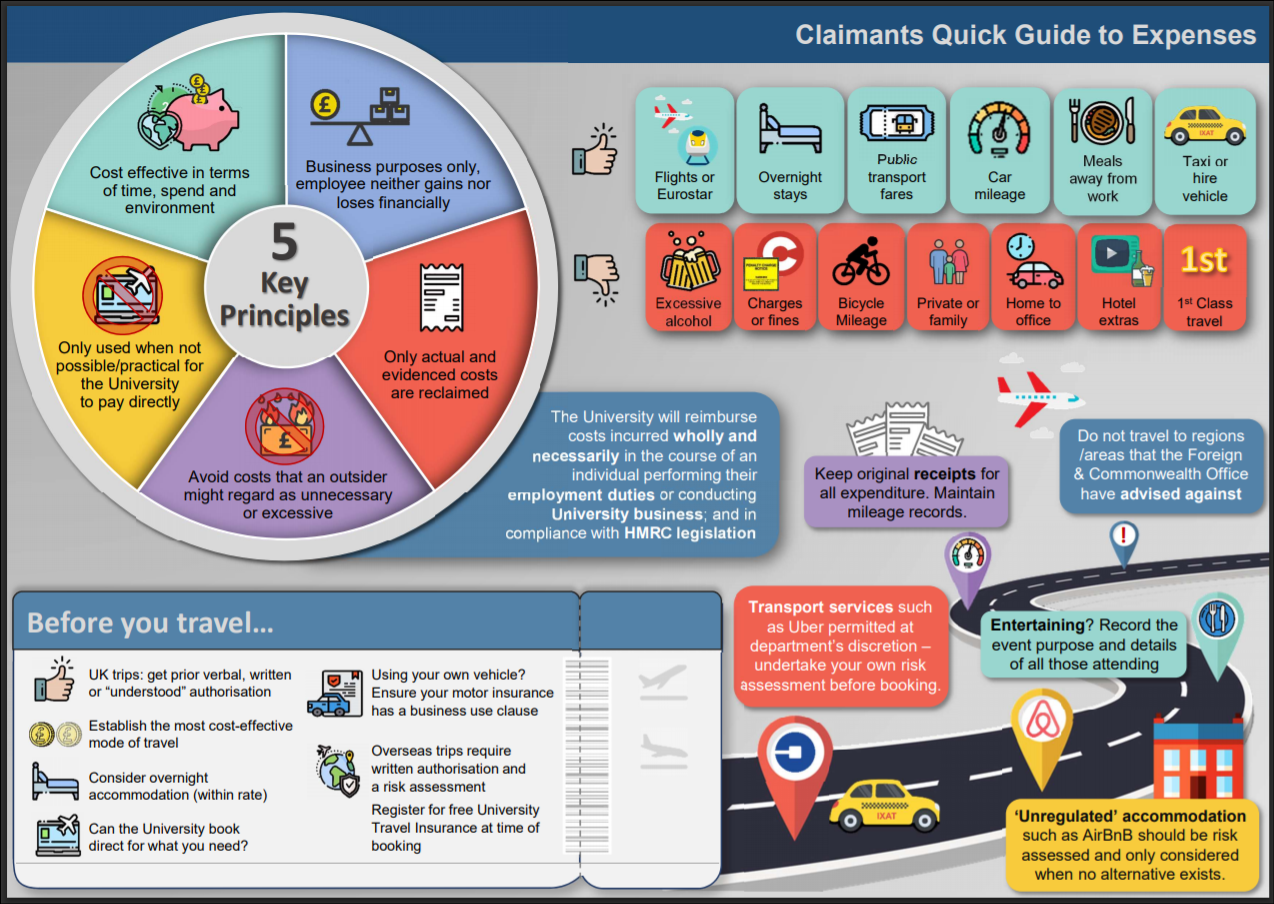

However, claimants may find the two-page quick guide below a useful reminder of the key principles, common items and UK mileage and subsistence rates.

Download the Claimant's Quick Guide to Expenses

How to make a claim

Concur is now available to all staff and should be used for all claims including Barclaycard claims. This link will open the Concur system page.

There are guidance documents and videos available on the Expenses Hub which detail how to use the use the system to prepare and submit expenses claims.

Page last updated 29-Apr-2024