The VAT implications of research income will differ depending on the nature of the arrangements and the parties involved. It is essential that the appropriate VAT rate is selected for each grant as the VAT status impacts both the research budget and the wider University’s expenditure and VAT recovery.

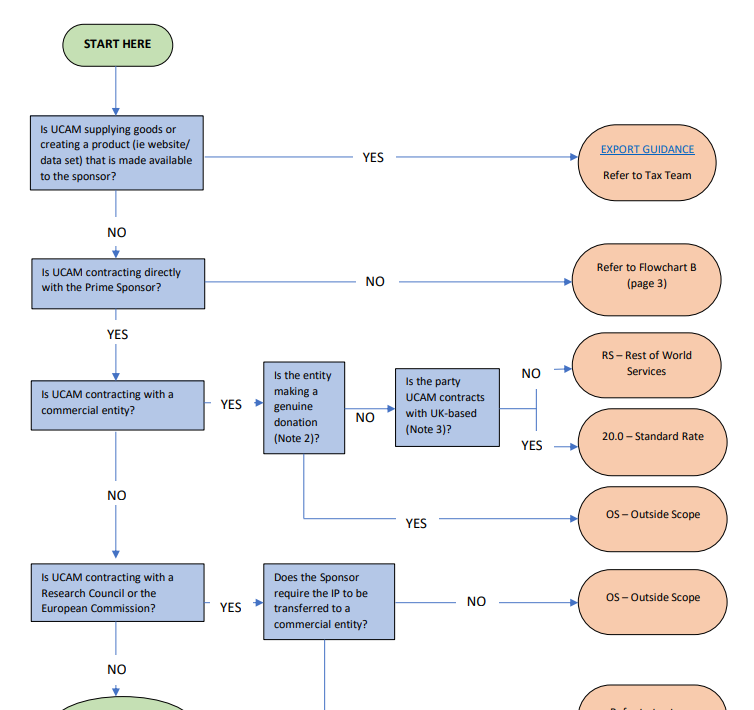

We have created the following tools to help determine the right VAT treatment when setting up a new grant.

- VAT Flowchart – which VAT code to use on CUFS for Research and studentships funds and income

- Funder / Sponsor cards – VAT issues summarised by type of sponsor

- What is a collaboration for VAT purposes?

Please contact the University VAT Team on VATqueries@admin.cam.ac.uk if you have used the above and are still unsure.

Click on image below to view the research VAT flowchart (Please note there are three (3) pages)

Please refer to chapter 19 for explanation of different VAT rates.