Petty Cash must be used exclusively for expenditure directly relating to University business. These shall be limited to items of expenditure below the cost of £25 unless the Director of Finance has given written dispensation to increase the limit.

Petty cash must not be used:

• To make payments to individuals (eg. payments to visiting lecturers to defray expenses).

• To make payments to external suppliers for services rendered.

• For the regular purchase of items that could be obtained through iProcurement (eg. the monthly replenishment of consumables such as tea and coffee, cleaning materials or light bulbs).

• To reimburse mileage or travel costs other than local bus fares between sites in Cambridge. In these cases University Expense forms should be used.

• For personal expenditure even if the intention is to reimburse the float later.

• For internal business transactions within the University ie. between departments (this includes the University Centre). In these circumstances, Internal Trading procedures via the UFS must be used.

Reimbursements

All payments from Petty Cash must:

• have had permission to incur the expense in the first place

• be supported by a receipted voucher; and

• be authorised by someone other than the claimant.

Claimants receiving reimbursement must sign for receipt of monies.

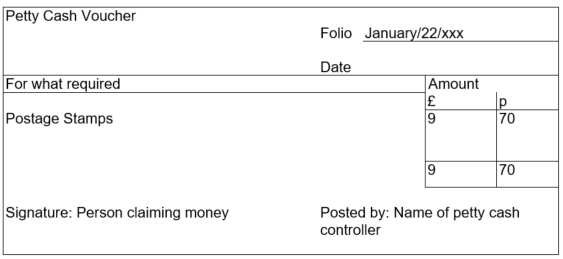

Petty cash vouchers

Petty cash vouchers must be used to record the nature of the expense and to act as a receipt for the reimbursement. All the information in the example below is required.

VAT and petty cash

Due to the complexities of the University’s VAT recovery rules it is not normally cost effective to spend the time ascertaining whether a proportion of any VAT incurred can be reclaimed for these low value purchases. Therefore, petty cash items should be posted to department accounts or grants at the gross value even if you have a valid tax invoice.

Taxable benefits

Provided petty cash is paid out in accordance with the conditions of use detailed above there should be no taxable benefit. Further advice can be sought from the Payroll Manager.