Introduction and overview

Heads of Institutions that receive income from the sale of goods or services, including Research, must establish procedures to ensure that all sales are authorised and supplied as agreed. All relevant risks to the University must be considered and managed and are made only to acceptable credit risks3 .

The procedures and considerations detailed in this section are designed to ensure best practice in relation to:

- the terms and conditions applicable for the goods and/or services to be provided

- whether to extend credit to external customers (debtors)

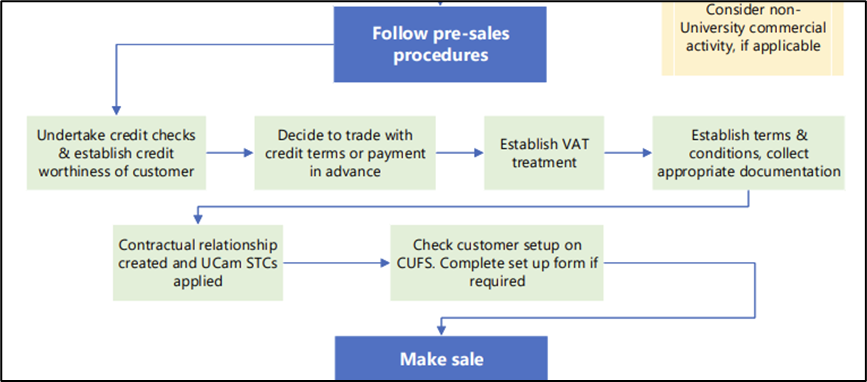

The procedures followed at the pre-sales stage of the trading process are essential for managing the financial, legal and reputation risks associated with trading activities. This section explains the pre-sales procedures to be followed. This needs to be considered in the context of the size, nature, and frequency of the transaction(s).

Pre-Sales Procedure

The following steps summarise the procedures institutions must follow before the supply of goods and services is made.

- Evaluate whether the proposed trading activity is appropriate for the University

- Assess of the creditworthiness of potential and existing customers

- Consider the particular credit risks associated with this activity

- Establish the correct VAT treatment

- Ensure appropriate terms and conditions of sales are used and issued to the customer

- Provide a quote for customer, if appropriate

- Ensure appropriate documentation e.g., purchase order, has been received from the prospective customer

- Check customer record is setup in UFS

3 Financial Regulations 2012, Income and Expenditure, section 12.1

Latest version 16 April 2024