Click on the titles below to display the full communication.

Q. 14 Sep 2018 | Suppliers not requiring an FD3 form to get Tax Clearance

From Monday 17th of September 2018, clearance from the Tax Team may be obtained for certain suppliers without submitting an FD3:

- Institutions / organisations / charities

- Landlords or accommodation providers

- Catering providers

- Companies with more than 10 employees

The request for tax clearance (or extension of an existing one) of the above suppliers, should be sent to the Tax Team by email to FD3@admin.cam.ac.uk and include the following information:

- Supplier name and CUFS supplier number (if already on the system)

- Company House reference number if applicable

- Supplier’s website if any

- Quote and/or document supporting agreed terms of engagement

Based on the information provided the Tax Team will either issue a clearance number, request additional information or ask the department to submit an FD3 form.

Warranties, delivery or freight services that are closely related to the purchase of goods no longer require tax clearance.

Q. 29 Mar 2017 | Processing invoices received from OPW

Off Payroll Workers (OPW) are paid via the University Payment System using a UPS4 form which can be found here.

All OPW payments are processed by Finance Division Shared Services. The VAT element of the invoice will be recorded on CUFS with any associated purchase orders linked accordingly and VAT reclaims made.

When you receive an invoice from an OPW complete the UPS4 form, attach the approved suppliers invoice and send to Finance Division Shared Services at Greenwich House.

Please note that the Online Supplier Form used to request new supplier set up on CUFS has been updated to take account of the need to assess suppliers for OPW status. CUFS has also been updated to flag on invoice entry if a supplier has a Tax Clearance Number that indicates it is an OPW to prompt such invoices to be submitted to the Finance Division Shared Services for payment via the University Payment System.

Q. 22 Mar 2017 | CUFS system change to support rule changes....

CUFS SYSTEM CHANGE TO SUPPORT NEW HMRC RULE CHANGES FOR OFF PAYROLL WORKERS

Off Payroll Workers (OPW) will be paid via the University Payment System using a UPS4 form which can be found here.

All OPW payments will be processed by Finance Division Shared Services. The VAT element of the invoice will be recorded on CUFS and any associated purchase orders linked accordingly. More detailed guidance on this process will be available shortly.

Currently Tax Clearance Numbers (TCN) are only assigned to self-employed individuals via the old FD3 process. To meet the new legislative requirements the new FD3 process will incorporate an extended use of TCN to include suppliers who have been assessed for OPW status under the new FD3 process.

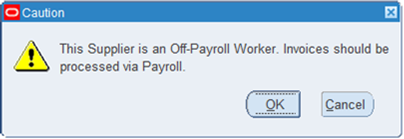

To help ensure that invoices are processed correctly CUFS has been updated to provide a warning on invoice entry if a supplier has a Tax Clearance Number that indicates it is an OPW. This is to prompt you to send such invoices to the Finance Division Shared Services for payment via the University Payment System.

If you have any queries about this communication, or you are currently negotiating or have already agreed a new contract with an individual where they provide services to the University (or Agencies providing such resource to the University) and need help or guidance on whether they meet the terms of the new tax legislation please contact the Taxation team on: selfemploymentstatus@admin.cam.ac.uk

Issued by: Jo Hall - Head of Financial Systems.